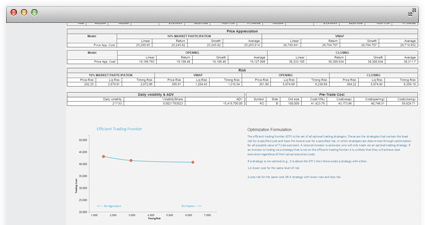

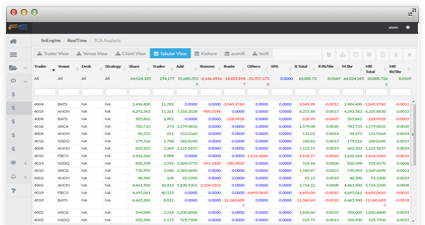

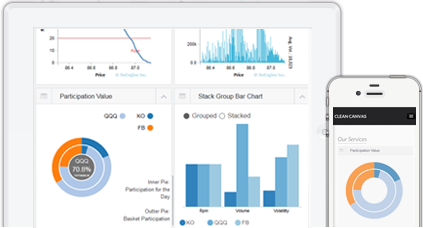

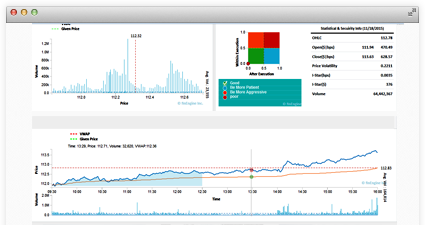

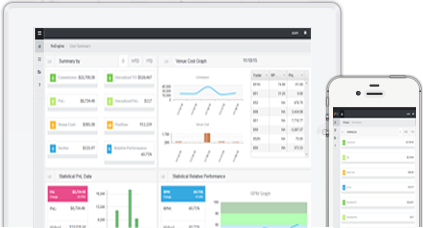

finEngine's wide range of analytical tools are designed to minimize costs and maximize trading effectiveness and profitability. We provide a various perspectives and levels of granularity into what is normally an overwhelming amount of data in order to allow quick interpetations of broad aspects from management or to allow nitpicking of individual orders and routing decisions by traders. Many of our products function in real time allowing for immediate feedback and aid in decision making.